3.4.2Management Board Remuneration in 2016

The Management Board remuneration in 2016 was governed by the Remuneration Policy 2015 with exception of the 2014-2016 LTI awards. These conditional LTI shares were granted in 2014 and are governed by the applicable remuneration policy at that time (Remuneration Policy 2011aa, which addressed the challenges of the turnaround period of the Company).

The actual remuneration over 20161 (see below) is set out below in four sections, namely 1. Base Salary, 2. Short-Term Incentive, 3. Long-Term Incentive and 4. Pension.

Remuneration of the Management Board by member

|

Bruno Chabas |

Peter van Rossum |

Douglas Wood |

Philippe Barril |

Erik Lagendijk |

Total |

|||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

in thousands of EUR |

2016 |

2015 |

2016 |

2015 |

2016 |

2015 |

2016 |

2015 |

2016 |

2015 |

2016 |

2015 |

|

Base salary |

773 |

800 |

537 |

522 |

110 |

532 |

459 |

396 |

410 |

2,349 |

2191 |

|

|

STI1 |

708 |

1,500 |

379 |

800 |

72 |

379 |

665 |

282 |

575 |

1,820 |

3540 |

|

|

LTI |

1,247 |

1,614 |

705 |

671 |

93 |

618 |

323 |

447 |

180 |

3,109 |

2788 |

|

|

Pensions |

245 |

223 |

151 |

130 |

28 |

138 |

115 |

102 |

102 |

664 |

570 |

|

|

Other |

159 |

410 |

264 |

235 |

8 |

143 |

358 |

32 |

15 |

605 |

1,018 |

|

|

Total Remuneration |

3,132 |

4,547 |

2,037 |

2,357 |

310 |

1,810 |

1,920 |

1,259 |

1,282 |

8,547 |

10,106 |

|

|

in thousands of US$ |

3,467 |

5,045 |

2,254 |

2,616 |

343 |

2,003 |

2,130 |

1,394 |

1,422 |

9,461 |

11,213 |

|

- 1 this represents the actual STI approved by the Supervisory Board which has been accrued over the calendar year, payment of which will be made in the following year.

1. Base Salary

The Supervisory Board decided that Base Salary levels would not change in 2016 compared to 2015. As such no indexation or other increases have taken place. However the Management Board itself has decided to temporarily reduce their Base Salary with 10% considering the difficult market circumstances and the reduction of the Company’s workforce. This decision is for the period of one year (12 month basis) and was implemented per September 2016. As such a (pro rata) decrease in Base Salary figures is visible in the ’Remuneration of the Management Board’ table between 2015 and 2016.

On November 30, 2016, Mr. D.H.M. Wood was appointed as Management Board member and was designated Chief Financial Officer. The annual full year base salary of Mr. Wood in 2016 amounts to EUR 440.000. The voluntary 10% reduction on base salary is not applicable to Mr. Wood as an overall re-assessment of the CFO base salary was done at his appointment.

2. Short-Term Incentive

For 2016 the Supervisory Board decided that equal importance would be given to both the Company and Personal Performance Indicators.

Relative Weight STI performance indicators 2016

In order to create long-term value for SBM Offshore, the Supervisory Board decided that in 2016 special focus would be required on Net Debt and cost reduction given the difficult market circumstances and the ongoing internal restructuring. As such these two items were the Company Performance Indicators for 2016, both carrying a relative weight of 50% (i.e. 25% of total). A scenario analysis of the potential outcomes in relation to the STI was done by the A&RC and subsequently monitored throughout the year.

The Personal Performance Indicators for the Management Board members were related amongst others to aspects such as strategic workforce planning, compliance training and awareness and implementation of improvement plans.

With regard to the Company Performance Indicators, the Supervisory Board, at recommendation of the A&RC, assessed the delivered results for each performance indicator and has concluded that:

- The results related to the Net Debt Performance Indicator were realized between the set target and maximum values;

- The results related to the cost reduction Performance Indicator were realized at maximum values.

In summary, the Supervisory Board regards the performance under the Company indicators robust. With regard to the Personal Performance Indicators the Supervisory Board, again at recommendation of the A&RC, concluded that the Management Board members dealt with the difficult market circumstances in a capable manner. Examples that substantiate this conclusion are the fact that dividend was paid to shareholders for the first time in five years, a share repurchase program was successfully executed, SBM Offshore improved its risk management system for new projects and good progress was made on remaining legacy projects and the follow-up of Project Yme.

As for the CSR & Quality multiplier, the Supervisory Board assessed that the delivered performance as a whole is best reflected with a neutral outcome in the Short-Term Incentive value (i.e. no down or upward adjustment). The total performance resulted in a STI award of 177% of Base Salary for the CEO and 131%-138% for the other Management Board members.

Early in 2016 the Management Board decided that unadjusted STI outcomes would be undesirable, given the difficult market circumstances, the focus on cost reduction and the downsizing of the Company as a result of the internal re-structuring. As such the Management Board has decided to accept only 50% of their achieved STI percentages, resulting in a STI award of 89% of Base Salary for the CEO and 66%-69% for the other Management Board members.

3. Long-Term Incentive

With regard to 2016 three LTI items are of importance, namely: the vesting of LTI granted in 2014 (which vested in 2016), the grant 2016 (which vests in 2018) and the level of share ownership at the end of the year.

LTI grant 2014

The 2014 LTI grant was governed by RP2011aa and contained three types of Performance Indicators which are displayed below:

With regard to these Performance Indicators, the Supervisory Board, at recommendation of the A&RC, assessed the delivered results and has concluded that:

- The results related to the Relative TSR were realized between the set target and maximum values;

- The results related to the (published IFRS) EPS were realized at maximum values.

The LTI grant 2014 is the last grant in which the Supervisory Board shall apply the Special Incentive. This incentive was (temporarily) created to properly align management and shareholders’ interests, where legacy projects and compliance enhancement are concerned. It basically provides the Supervisory Board with some flexibility to reward the Management Board members for long-term value creation within SBM Offshore that, they believe, has occurred but is not (yet) sufficiently reflected in the other (more financial orientated) Performance Indicators.

The Supervisory Board decided that the achieved results on both EPS growth and Relative TSR insufficiently reflected the value that the Management Board members added to SBM Offshore since 2014 with regard to the turn-around of Company. Therefore the Supervisory Board applied the Special Incentive in order to award maximum vesting of the LTI grant 2014. The 2014 LTI awards were granted to Mr. B. Chabas, Mr. S. Hepkema and Mr. P. van Rossum as Management Board members at that time.

LTI grant 2016

The 2016 LTI grant is governed by RP2015 and the chosen performance indicators and their relative weight will be disclosed in the annual report at the end of the three year performance period.

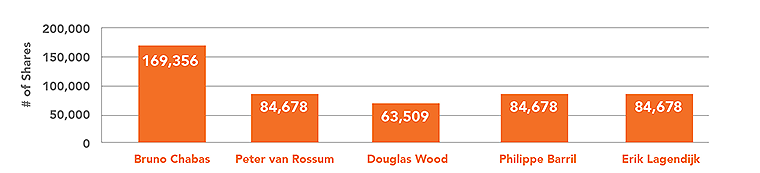

For the year 2016, the graph ’Maximum LTI Opportunity 2016-2018’ displays the conditional (and maximum) share grants that were awarded to the members of the Management Board for the performance period 2016-2018. The number of shares that will actually vest depend on the actual performance against the set targets but will not exceed the maximum numbers displayed below.

Maximum LTI Opportunity 2016 - 2018

The LTI opportunity of Mr. van Rossum will be pro rated due to his retirement prior to completion of the relevant performance period.

Mr. Wood’s LTI opportunity is relatively low due to his recent start at SBM Offshore. In addition to his (pro-rata) LTI opportunity Mr. Wood was granted 30,000 Restricted Share Units upon joining SBM Offshore. This award aims to compensate Mr. Wood for a loss in his variable income at his previous employer.

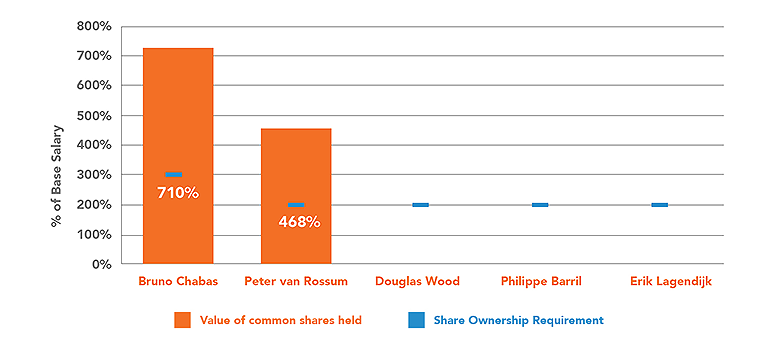

Share ownership requirements

As stated above, each Management Board member must build-up a certain percentage of base salary in share value in SBM Offshore. For the CEO this level is set at an equivalent of 300% of base salary and for the other Management Board members, the level is set at 200%. The graph below displays the actual shareholdings of the Management Board members per the end of 2016 in which only common (unconditional) shares are taken into account. Due to their relative recent appointment Mr. Wood, Mr. Lagendijk and Mr. Barril, have not yet met the share ownership requirements.

Level of Share ownership per MB member

More details on the share-based incentives are provided in the Appendix on Share-Based Incentives at the end of this Remuneration Report.

4. Pensions

Management Board members receive a pension allowance equal to 25% of their base salary for pension purposes. Since these payments are not made to a qualifying pension fund, but to the individuals, the Management Board members are individually responsible for investment of the contribution received and SBM Offshore withholds wage tax on these amounts.

Other elements of 2016 Management Board Remuneration

Allowances

The Management Board members received several allowances in 2016. Most notable is the car allowance which is received by all and the housing allowance for Mr. Chabas and Mr. Barril. The value of these elements is displayed in the table ’Remuneration of the Management Board by member’, at the top of this section.

Retirement of Mr. van Rossum

Mr. P.M. van Rossum retired as Management Board member during the extraordinary meeting of shareholders of November 30, 2016 and his contract will end at the Annual General Meeting of April 13, 2017. No severance pay was paid to Mr. van Rossum.