1.5Competitive Landscape and Market Positioning

Segmentation in the FPSO Market

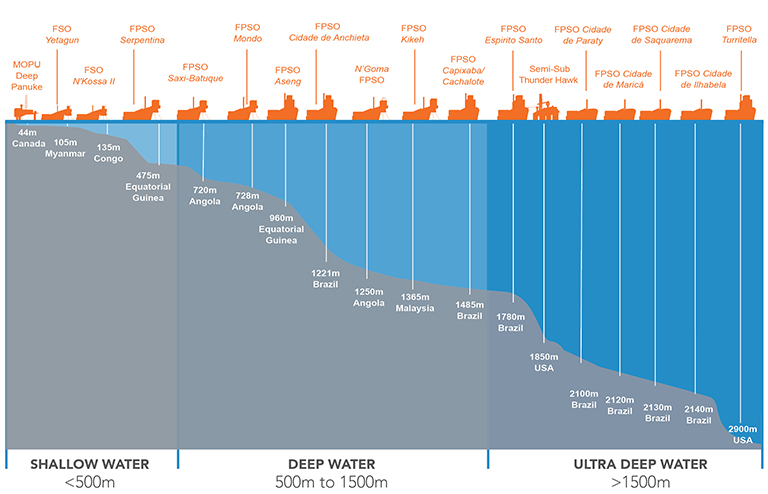

The global market for FPSOs can be roughly split into three segments, with SBM Offshore to date most active in large conversions but with its Fast4Ward FPSO design, the Company is also moving towards the newbuild category:

- Newbuild FPSOs: with production volumes of over 200,000 barrels of oil per day. To date SBM Offshore is involved in this segment mainly as a supplier of large Turret Mooring Systems (TMS).

- Large conversion FPSOs: this is SBM Offshore’s main market. They are usually converted oil tankers known as Very Large Crude Carriers (VLCCs), with typical production capabilities of 60,000 to 150,000 barrels of oil per day. The Company’s key competitor in this market is MODEC. A typical Generation 3 FPSO – what SBM Offshore calls its latest design for the complex, pre-salt fields – takes approximately three years to complete, at a cost of US$ 2.0 billion approximately, two such FPSOs Cidade de Maricá and Saquarema were delivered by the Company in 2016 and are now operating in ultra-deep water – where the Company’s expertise lies.

- Small conversion FPSOs: based on smaller crude oil tankers, with production rates up to 60,000 barrels of oil per day. Although SBM Offshore is not particularly active in this market the Company delivered FPSO Turritella in 2016 for Shell’s Stones development, which has a production capacity of 60,000 barrels of oil per day. The FPSO breaks the industry record for the deepest FPSO.

Lease FPSO Market

Segmentation of SBM Offshore fleet/water depth

The commonality for all FPSOs is their bespoke characteristics: each oil field is unique with different pressures, temperatures, oil/water/gas mixes, corrosive and/or H2S elements, API factors, etc.

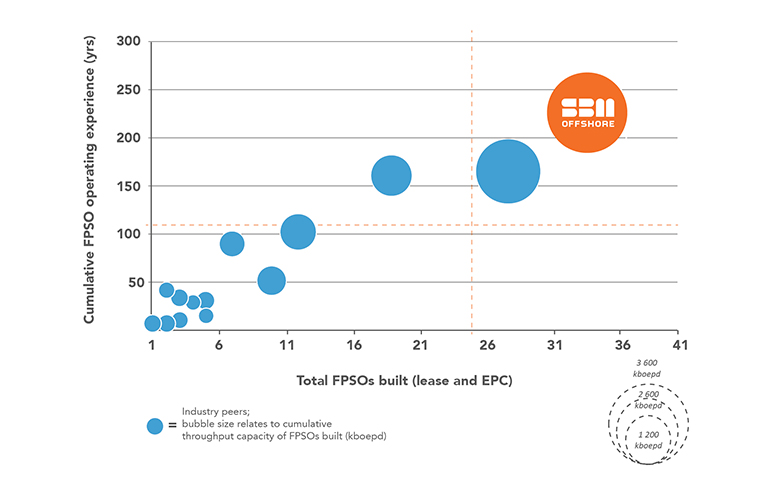

Due to overall reduced demand, competition is increasing as other companies are stepping out and participating in tenders for FPSOs in other segments, which they have not done previously. For clients, awards are increasingly driven by pricing considerations. SBM Offshore is uniquely placed to respond with its unrivalled experience in executing and operating FPSO projects and its understanding of the inherent risks and challenges of the different segments.

SBM Offshore’s Positioning in the FPSO Market

Boundaries are fading as several competitors are developing execution capabilities for larger size conversion projects and targeting a position in SBM Offshore’s focus market segment.

SBM Offshore is a leader in the FPSO market both in terms of scale economies and track record, on key indicators for cost, schedule and risk reduction. To keep this leading position, the Company continues to invest in new technology, offering new solutions to clients.

- A technology development program that focuses on enabling access to new frontiers and production and on reducing the schedule and cost of existing solutions, in particular through standardization and customization approach such as the Fast4Ward – the Company’s newbuild FPSO project

- Leveraging the Company’s experience and business model by strengthening its position in its core markets, Africa and Brazil, while looking to enter new regions. When entering new countries, the Company develops local sustainable business, meets local content requirements and invests in the local communities

- The Company’s track record in both project delivery and operations provides clients the necessary comfort in their search for ‘predictability of outcome’. Experience matters and the Company believes that going forward the industry winners will be the experienced subcontractors

- Offering cost-optimized solutions across the full life cycle of projects, thereby leveraging the full suite of floating production solutions that the Company can offer and the depth of experience and expertise, executing the work from cradle to grave

Looking forward

Although the Company signed the industry‘s only FPSO award, which is subject to FID, 2016 was another slow year for SBM Offshore and the entire industry. Given the low oil price and the pressure on capital spending by its clients, SBM Offshore predicts that this trend will continue for the short-term.

With dedicated teams focused on providing the best possible technical and commercial solutions and by leveraging its core competencies with a more efficient and responsive organization, SBM Offshore expects to be able to capitalize upon new opportunities and prospects.

In particular the Company is looking at transforming the way it can execute projects through initiatives such as Fast4Ward for – but not limited to – large pre-salt field developments, also at the other end on marginal field development by integrated field development solutions – always with a cost optimized focus.

Thanks to its experience, SBM Offshore is also able to provide fleet support and brownfield life extension and redeployment solutions, as well as decommissioning expertise to its clients.